P/E MULTIPLE OF TURKISH COMPANIES HIT THE 9 YEAR LOW IN 4Q 2018 AS A RESULT OF INCREASED POLITICAL AND MACROECONOMIC RISKS IN TURKEY AND WIDER IN THE MIDDLE EAST. M&A ACTIVITY HALVED ALREADY IN 2016-2017 , MAINLY AS A RESULT OF BIG, INFORMED PLAYERS’ ABSENCE. MANY ARE QUESTIONING THEMSELVES “IS IT NOW THE TIME TO BUY A TURKISH COMPANY OR WE ARE WITNESSING A TEMPERED BOMB?”

Good conditions for corporate acquisitions in Europe

Relative power of companies in the developed world increased in the period after the financial crisis. Economic conditions in 2016, 2017, 2018 were/are prosperous, while the access to money is relatively easy and cheap. M&A activity in the developed world is on the other side reaching historical heights. Many companies gathered free cash resources and are thus facing questions such as which company to buy, when, at what price and how to properly address the risks.

Impact of macro on corporate valuations in Turkey

Valuations of Turkish companies are for some time already at the spotlight of the foreign financial analysts and companies with the inorganic grow (M&A) ambitions. Turkish BIST 100 P/E multiple dropped in first 8M period of 2018 from 9x to 7x and hit the lowest levels in last 9 years. Its maximum was in 2013, when the multiple reached 12x.

A fast look into the multiples may indicate a good entry point. However well-informed big M&A players pressed a brake. Main fears are gathered around the potential impact of future macroeconomic & political risks on business operations. Let’s point out few key developments:

- Turkish Lira is continuously loosing its value against the EUR or USD for last 15+ years. The Aug 2017 – Aug 2018 decrease is significant and amounts to 40+%. Futures (CME) in Aug 2018 forecast a significant further drop also for the following years, while the costs of hedging are increasing steadily.

- Inflation rate in July 2018 reached 15,85% p.a. From Mar 2018 it is up for 5+% points and is increasing exponentially. Current inflation levels are the highest from Jan 2004 and are significantly above the long-term target inflation rate.

- Turkish companies are in average well-exposed to FX risks. They hold significant amounts of loans in EUR and USD.

- Significant credit risk eruption seriously threatens Turkish companies. Excess of serious liquidity problems may occur due to the maturity gaps between investments and loan financing.

- Country risks grow rapidly. 5Y credit default swap for Turkey increased for 350 basic points compared to the BOY 2018 and reached 500 basic points in Aug 2018.

- Average cost of debt for companies is high. Average interest rate for company loans reported by Turkish Central Bank reached 21,75% p.a. in Jul 2018.

- Payment discipline problems as well as payment terms are on the rise. Liquidity ratios of Turkish companies are worsening. Average trade receivables outstanding (TRO) in 1H 2018 amounted to 121 days, nevertheless 46% of business partners demand a significant increase.

No matter the environmental and industry analysis, the final conclusions related to the feasibility of the M&A activity is determined based on the individual case and in line with the corporate value-maximization principles. Besides the underlying case findings, the decision whether to involve in the M&A activity and at what price heavily depends among others also on motives, strategy and alternatives. One should be well aware of risk-benefit profile and accept the decision based on the well-informed decision making process.

Let’s look at the case study of a B2B multinational industrial company and how they addressed the question of increased risks linked to the operations in Turkey.

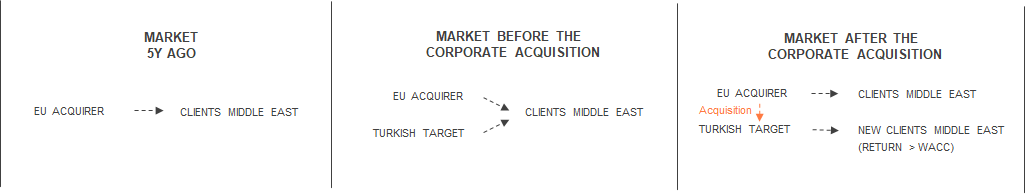

The background of the corporate acquisition:

Acquirer holds a dominant niche position in Europe and wider. It is considered as a reliable, high-quality supplier with a wide portfolio of own products. The company is active in the CapEX intensive industry. It reached its leading market position due to the fact that they were able to internationalize its business operations faster and thus reach the economies of scale and scope, which nowadays represent hard-to-beat market entry barrier. Part of the success can also be attributed to banks, which were for a long period exposed to above-average indebted company.

Turkish target is a direct competitor of the acquirer and was founded as a result of the acquirers’ clients activity, to decrease their dependency and regain the negotiation power. Once the target started to threaten the performance of the acquirer more seriously, the company adjusted the regional pricing policy and thus strengthen its competitive pressures. Due to the limited financial power and negative macro development, the competitor offered the acquirer the option to acquire the company.

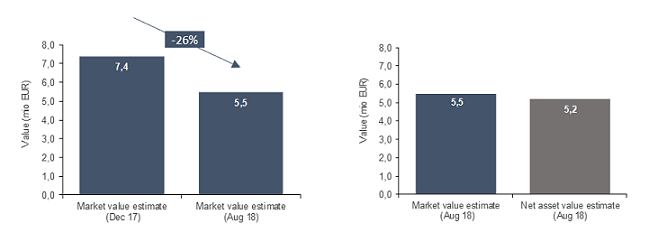

Corporate market value estimate of the target in the context of recent macro developments & risk perception:

Comment: Target’s market value estimate is attractive, especially if considered in the context of historical pricing. Only from the BOY 2018 the company lost more than a quarter of its value. P/E multiple of the target is also cheaper than the reference industry / market multiple, reflecting the acquirer’s competitive pressures. Market value estimate is approximately on the net asset value, which is used as a post-acquisition strategy base. The commercial side of the deal is stimulative for the acquirer.

Corporate acquisition related risks and post-acquisition strategy

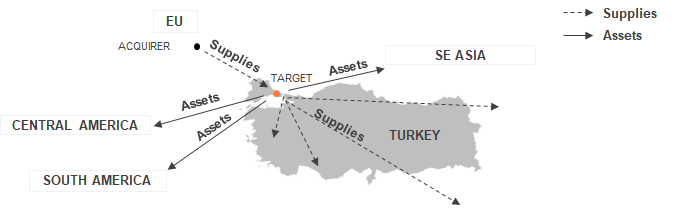

In order to limit the effect of high risks on future business operations and value generation, operational restructuring is planned.

- After the corporate acquisition part of the capacities double. The plan is to move them to other continents, where the acquirer already supplies some (other) products from its portfolio to certain clients. Local production will open new business development opportunities and good base to increase the value generated / revenue synergies.

- After the corporate acquisition products for existing Turkish and Middle East clients are to be produced on more efficient production lines of the acquirer within the EU. To guarantee sufficient flexibility the supply will be coordinated through the local warehouse.

Corporate acquisition enables also realization of selected new business opportunities. Projects relate to Turkish and Middle east clients and are only available to local producers with sufficiently advanced know-how. These projects are planned in line with the value creation principles. In other words, due to high operational risks only execution of projects with returns above the weighted average cost of capital take place.

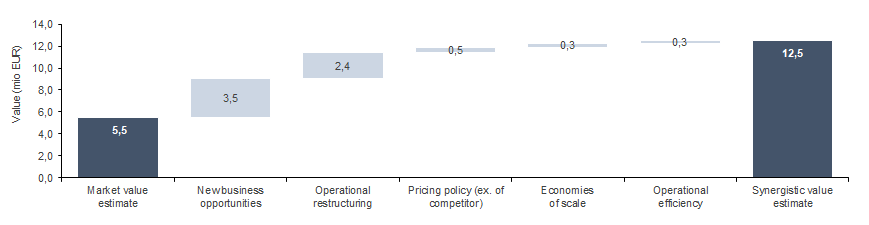

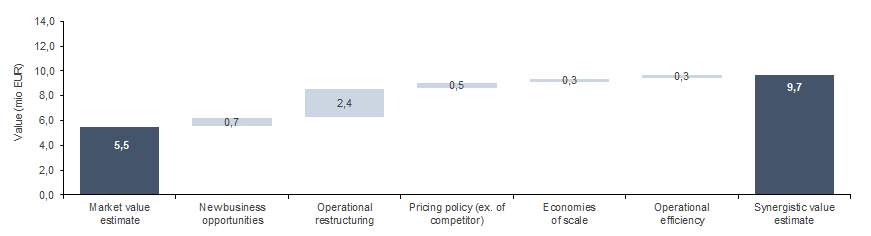

Base scenario (symbolic graphics; imaginary numbers are used):

Comment: The corporate acquisition results in synergies as presented above. Additionally created value supports the decision to acquire a company.

Worst-case scenario (symbolic graphics; imaginary numbers are used):

Comment: New business opportunities are due to the environmental challenges limited. Operational restructuring works as a shield to protect against eruption of risks after the corporate acquisition. The core value is thus significantly less exposed to Turkish risks.

Market entry (corporate acquisition) is attractively priced and is from the perspective of the acquirer a good business decision, while post-acquisition strategy limits the effect of further negative risk development. Additionally, the acquirer also plans to:

- minimize the exposure to Turkish Lira (change most of the existing commercial agreements to EUR; hedge the TRY-EUR FX rate risks)

- minimize the exposure to risks related to Turkey (continuous excess cash pay-outs / reinvestment, optimization of net working capital and financing mix)

The recent developments of risks in Turkey, enabled the acquirer to 1) execute the business acquisition (acquire the competitor), 2) consolidate the business operations and improve the operational efficiency, 3) speed up the the Middle East market entry and develop the regional presence. In the given case the transaction size matches the net asset value, which the acquirer used to relocate certain duplicated capacities (fixed assets) to other continents. The focus of the post-acquisition strategy addresses high risks and provides the answer how to restructure the operations to maximize the value. Despite the fact that the majority of companies decided to put their M&A activity in Turkey on hold, the given macro situation offered the acquirer an attractive business opportunity.