TECHNOLOGY BRINGS REVOLUTIONARY CHANGES INTO THE BUSINESSES. IT ENABLES NEW DIMENSIONS OF COST OPTIMIZATION ON ONE SIDE, AND EXTREMELY FAST AND CHEAP EXPANSION ON THE OTHER SIDE. THIS CENTURY IS FOR SMART INVESTORS DEFINITELY A GOLDEN ERA. FROM THE PERSPECTIVE OF VALUE CREATION, MEGA INVESTMENT OPPORTUNITIES ARE SHOWING ON THE INVESTOR RADARS – CASE OF MASTERCARD INC.

Mastercard Inc. is a specialized technology company offering e-payment solutions to banks, governments and others. In other words, clients are offered super-fast network for processing end-users’ transactions. The company philosophy is to simplify and upgrade the payment process. Efforts of the company are built around the main concern – to offer safety and security. The company today has 1,8 billion cardholders around the world, mainly in USA, UK, Canada and Brazil. Their brands MasterCard, Maestro and Cirrus became known as synonym for non-monetary business.

Sustainable achieving of high margins in the long-term

Through decades of operations the company developed key competitive advantages, which guarantee today’s success and include strong brand, high level of trust and global network of partnerships. Strong brand impacts the demand, high level of trust as the element of differentiation enables high profit margins and global network of partnerships results in economies of scale and optimal cost structure of operations.

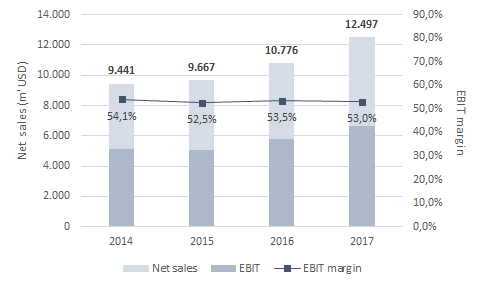

Financials confirm the superb performance of Mastercard Inc. Market share of the company in 2017 hit 17% (2016: 16%, 2015: 12%), while net sales reached 12,5 billion USD. Business performance is improving as a result of consumption rise and changing consumer habits. In terms of value creation, an important fact is linked to the ability to maintain high and stable margins. EBIT margin for years already exceeds 50,0%.

Chart: Net sales and EBIT developments of Mastercard Inc.

Shareholder value creation is what really counts!

The success story of Mastercard Inc. (or some other company operating in tech-sector) recognized by investors is actually a bit deeper. It is linked to the potential of future value generation, which is significantly impacted also by a relatively low operations growth financing needs.

Technology is an interesting phenomenon. It allows one to reach economies of scale fast and without significant investments in capital expenditures (CapEx) or Operating expenditures (OpEx).

The growth as such for Mastercard Inc. does not represent a significant financing burden (compared to non-tech sector companies). In other words, the operations can expand through the existing solutions and significantly impact the value created. If we additionally take into the account the fact that nowadays still 80% of transactions are in cash and the pace of changing consumer habits, we understand the true value drivers.

How easy it is for Mastercard Inc. to finance its existing operations is obvious even now. Despite the relatively high (16,0%) growth of net sales in 2017, the level of shareholder’s equity remained on the same levels. Net profits were paid out in full. The needs of increasing invested capital were addressed completely with increased levels of financial debt. Despite raising of the financial debt, the indebtedness ratios are actually improving, since the market value of equity increases faster than the financial debt.

Every company has its own specifics of shareholder value creation, so it is important to understand what boosts company value the most!

The CEO of Mastercard Inc. Ajay Banga says: »Our investments are focused on the safety, security and development of solutions that fuel high growth of our business.« He is well aware of the areas of the biggest risks and the biggest opportunities. This fact confirms also recent acquisitions, which are executed with a purpose to expand the capabilities of the company and take over the technical solutions, which are about to present a competitive edge for the company in the future. For example, with acquisition of VocaLink Holdings Limited company gained advanced know-how in the area of real-time account transaction processing; with acquisition of Brighterion, Inc. the company gained the AI technology to better understand the transaction flows and prevent the security and safety gaps.

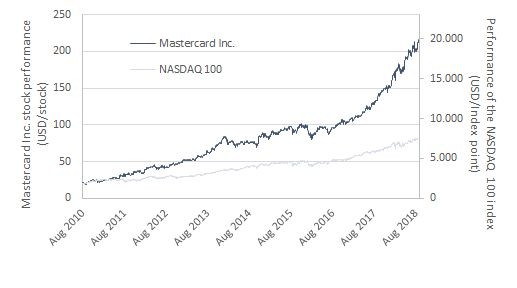

Companies that continuously create value for shareholders have competitive advantage over competitors and wider, meaning in the industry. In case of Mastercard Inc. we talk about the combination of attractive industry and strong competitive advantages. The company stock outperforms even those with biggest potential, selection of NASDAQ index companies.

Chart: Performance of Mastercard Inc. stock vs NASDAQ index

The thoughts of Mastercard Inc. management are concentrated on the core value driver – company’s growth and securitisation of underlying risks. The tools used are exclusively of technological nature. Technology & competitive advantages are the answer to smart managing of companies in 21st century.

The pace at which the technology is brought into the daily operations is high. It requires introduction of new business models. Preparation of more advanced business strategies. Continuous restructuring of activities. Implementation of creative ideas etc. As a result, the capital market positions of the most active companies are drastically improving. They attract investors. Grow the value for shareholders.

What about you? Are you aware of potential that the technology has in the context of your operations? Do you consider its implementation? Do you know which investments are smart and which actually represent a burden for your company?

What are the other shareholder value creation success stories that we know?

Company Uber offers transportation services and has no cars; Facebook is a media company and creates no content; Alibaba is a trading company with no stocks; Airbnb markets real estate, which are in possession of others etc. All these companies master the technology and its impact on value creation. Technology is revolutionizing the whole industries, which is primarily the cause why many sectors stagnate.

The answer on how to “Uber-ize” many other businesses is hiding the potential for new billionaires!