Business ownership is considered as successful if the investment generates a certain return between the deal entry and deal exit. Both milestones – entry (when you either buy a business / open a company) and and exit (when you sell a business / close a company) – are crucial to the investor, albeit often poorly addressed. How to approach the M&A process? How can the M&A process be approached? What are the key factors of the M&A deal success? What motives will encourage you to think about this step and how many other motives will be overlooked? What deal is realistic to expect? Does the M&A transaction offer you a base for your future changes? Below you will find answers to these and many other questions …

Buying or selling a business – how to approach?

First and foremost, it is very important to know how to deal with the M&A. Over the decades, the market has shaped the M&A process to such extent that it consists of the most optimal activities. It reflects the knowledge and experience of all participants who have dealt with mergers and acquisitions in the past. Therefore, going for a non-standard approach is unlikely to pay off. Information exchange, process dynamics, risk perception, and last but not least, trust gaps critically affect the likelihood of M&A deal success. Consequently, the misconduct of M&A process & M&A best practice is often just a waste of time and money.

Businesses for sale or businesses looking to acquire need a professional. They need someone to prepare them for the M&A process. Not only in terms of documentation, but also in terms of forming beliefs. The expert can be an internal or an external person. Since such transactions are more of a one-off nature than a continuous approach, companies usually seek the help of specialized financial advisers. The key to choosing the right expert is to have the right knowledge, experience and most importantly – your trust. Statistically, more than 60% of business acquisitions are unsuccessful from the perspective of shareholders’ value creation. Therefore, M&A deals are more than obviously very delicate, so critical assessment of the opportunity is of crucial importance.

Key hints LINKED TO BuyING or sellING businessES

Due to the complexity of M&A transactions, matching the needs and expectations of parties involved usually lasts and requires considerable effort. Changes in the business environment of the subject business, one-off events or something else normally require updates of financials, further explanations, etc. The latter is often seen as a burden. Motivation plays an important role in M&A deal-making, so don’t give up too fast!

Expectations of participants should be formed on a well-founded basis. Too big difference in expectations and perceived value is often negatively accepted by the opposite party. Such behavior does not improve the negotiating position, as many people think, but rather repels the potential investors. For that reason, more serious M&A players expect from the other party to engage the M&A consultant to conduct services such as due diligence and corporate valuation.

Many are surprised by the fact that a typical company is sold on average over a period of one to two years. Time depends on many factors, including equity share size and characteristics, attractiveness of the company and the industry, plans and activities of the controlling owner, capabilities of the management, profitability, growth, financial position, hedging options, dividend policy, general market conditions, etc. Due to that matter, ownership changes require preparation and vision. Especially for those older owners who may even be involved in running a business, it is crucial that they start thinking about transferring ownership on time.

Successfully executed mergers & acquisitions also require a great deal of tact and flexibility. The analysis of comparable transactions serves to determine the valuation and payment terms, but also provides a great insight into the individual M&A transaction structures and the specifics that participants have explicitly addressed in certain ways in the past. It is therefore possible to identify in advance how atypical the participants’ individual expectations are and to assess how likely they will be accepted by the counter party. Not being flexible may compensate through the loss of value, so make sure that you are aware what is realistic and what are the related boundaries.

No matter how much the participants of the M&A process strive towards rational behavior, it is always possible to detect involvement of some emotions. There is nothing wrong with it, as long parties are not misled. Some major fails can be linked to lack of proper control over individual’s weak points, unsuccessful prevention of extremely negative/positive thinking, no mechanisms to prevent irresponsible behavior, poor coping with pressure etc.

Business value is derived from discounted future benefits in the numerator and risks in the denominator. From that perspective, actively addressing probabilities of negative business surprises and unwanted operation turmoil is a must. To be more concrete, investors often appreciate the willingness of executives to remain on board, at least in the foreseeable future, after the stock purchase agreement (SPA) or asset purchase agreement (APA) is signed. If existing executives no longer see themselves working for the subject business, the M&A deal may easily fail. For this reason, it is important to understand how all parties see major risks and come up with mutually acceptable options of ownership transition.

M&A best practice business cases prove that integrity, objectivity and transparency importantly contribute to building the prerequisite trust among participants in the M&A process. The information should thus be presented as it is. For example, what does a SWOT analysis tell you if it mostly lists strengths and opportunities, although in reality the subject business also has plenty weaknesses and threats? It is likely that after one realizes the biased approach, he or she will be more suspicious about the information you will share next. Participants, however, appreciate that certain information also comes from the right mouth. Hiding things can have very negative consequences even after the M&A deal is done.

The prerequisite to successfully close the M&A deal is also to adequately inform the counter party. However, participants should also be aware of the sensitive nature of the M&A process and information. It is therefore necessary to responsibly agree terms and limitations of sharing and use of information. There is often a fine line between responsible handling and complication. From this point of view, coordination between participants is sometimes challenging and knowledge of standard practices is inevitable.

Mergers & acquisitions are usually of more significant importance to parties involved. Decisions made are therefore not really a matter of reckless behavior. Both sides play own tactical game to maximize benefits. Regardless of different views, respectful and professional communication is expected. Often, the M&A process progresses faster, when neutral person intermediates, interprets, complements and guides both parties.

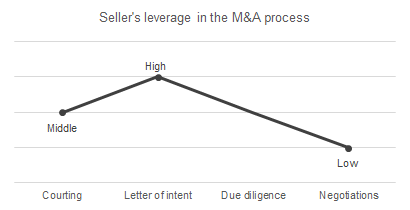

One of the most important things we all too often forget is that the bargaining power of buyers and sellers throughout the M&A process is not always the same. In the initial stages of the M&A process, when more potential buyers are on the horizon, the seller is in a much better position than the buyer, but towards the end of the process, when only a few are given the opportunity to advance, the situation is reversed. Due to that, any missed opportunities are difficult to make up for. For example, the letter of intent often comes incomplete, also as a reflection of the desire to continue with “more serious” activities. The seller should strive to point out the LOI deficiencies immediately, since the bargaining power is in this stage at its highest levels. Nonetheless, the way how the letter of intent is drafted also very well indicates the true motivation for the party and the level of experience.

Source: Consilue analysis.

To successfully target the potential investors, one needs to be aware of the situation that best describes subject businesses for sale. Are we talking about the growth capital, succession, MBO, carve-outs, spin-offs, distressed business or others?

Potential strategic acquirers typically focus their attention on consolidation of business entities or business assets. In other words, generation of synergies through economies of scale, diversification, resource transfer or a combination of the above plays an important role. The more synergies there are, the higher the appeal to buy certain business. Finding the right players and informing them properly about the investment opportunity is therefore crucial to successfully complete M&A transactions.

It is important that participants enter the M&A process well-informed, determined and with clear expectations. The following is of extreme importance especially when skillful buyer leverages its negotiation power and agrees on exclusivity period in exchange for resources invested in due diligence, corporate valuation and negotiations. For the seller, this is often seen as a sort of a bet, since the decision has to be made on the pre-formed sense of the market.

WHEN TO Buy or sell business?

Competition today is increasing. More and more companies and industries are entering in the mature phase of their life cycle, which reinforces the need for inorganic growth. This is the reason why lots of them nowadays have M&As even as part of their strategies. In the mature phase smart M&As often boost shareholders’ value creation more than organic growth.

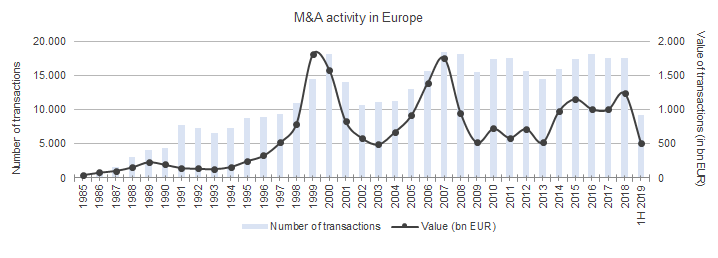

Source: IMAA. Consilue analysis.

Despite the increasing number of M&A transactions, times to sell or buy a business are not always appropriate. It is important to be aware of where we are on the M&A activity curve and what are the factors that influence this situation. Currently (in 2019), the EU M&A market is positively affected by relatively attractive corporate valuations, high liquidity, easy access to credit and others. The graph clearly shows that current levels are lower in value terms than they were before the financial crisis, which is not the case for the United States. As Europe loses on its competitiveness, it also becomes less and less attractive in terms of consolidation trends. However, it is true that every industry and every market has its own specifics of movement and it is good that the participants are aware of them.

Our success in mergers and acquisitions is also significantly influenced by M&A trends. Recently, for example, investors have been giving an increasingly important role to technology. Then there are unexpected tariffs initiated by the US, which caused a wave of Chinese investment in Europe and so on.

HOW TO DECIDE WHETHER OR NOT TO Buy or sell business?

The decision to sell or buy a business must be made rationally. Every business opportunity has its own life cycle in the eyes of every individual. But also times are good and bad in the eyes of every individual. The market requires more each day. Wiser ones use their ability to adapt as their advantage, others don’t. The important thing is, that we either take the opportunities or we begin to lose. There is no room to debate when selling and buying businesses. Investing is not politics. Selling or buying a business is not a bad decision. Not making a progress when running a business is. The market sooner or later eliminates those that operate below its requirements, so it is wise to realize this as soon as possible and take action.

It may happen that one is forced to make an investment decision (buy or sell business) due to third factors, so knowing the probabilities of such events is important. Sometimes it is better to take a preventive action as well, especially when we are on the edge of major macroeconomic or geopolitical concussion.

Corporate owners often get asked how much their business is worth. Most of them are not able to answer this question properly. Such ignorance is detrimental and can also be a reason for lost opportunity. Behind many such questions there is a potential acquirer, so it’s always good to be aware of your investment’s value.

Investment decisions, in knowledge, in technology, in assets, or something else, tailor our destiny. What we invest in today impacts our yield tomorrow. Compound interest is the thing that makes us, or not, more successful in time. According to Albert Einstein, this is the most powerful force in our universe, so it is nonsense to oppose it.

Are you interested in the M&A support that we can offer? Share with us some data through web form – Mergers and Acquisitions – M&A consulting!