THE LEADING MULTINATIONAL COMPANIES EXPLOIT ADVANCED KNOWLEDGE OF STRATEGIC CORPORATE FINANCE (INCL. VALUE-BASED MANAGEMENT) TO MASTER THEIR DECISION-MAKING. WITH OPTIMAL OPERATIONS THEY BUILD THEIR WAY TO RECOGNIZED MILLION DOLLAR POTENTIALS.

Nowadays we are witnessing a serious competition among companies in the market. The world changes at extremely fast pace. Requires agile, self-learning businesses, flat organizational structures, innovativeness in the whole supply chain and wider, implementation of digital in all processes and many other characteristics, which are nowadays preliminary for the success of corporates. Doing business became complicated in its simplicity, while one of the crucial questions being asked today is “How the right decisions are made in the firm on every level?”

Value-based management became in last two decades the “religion” of the leading corporations around the world. It refers to the theory of corporate finance, focused on shareholder’s value maximization. The value is the only indicator that reflects information in a complete, comprehensive and non-biased way. What is more, value added approach enables one to address all processes and stakeholders in a simple way, with one single number.

»The only relevant KPI for owners is the value of their equity share.«

Value-based management – GOOD PRACTICE?

One of the cases where good practice of value-based management is present is Sika Group, a chemical producer giant with HQs in Switzerland. This multinational has 200 companies around the world and is present in 101 countries. It generates 6,25 bn CHF net sales and constantly brings 25%-30% return on invested capital (ROIC). Added value per employee is 115.000+ CHF. Under the umbrella brand Sika, 850+ product brands are promoted. The company persistently grows, organically and with M&As. Only in 2017 the company executed 7 acquisitions and registered 74 patents. And why this multinational is so successful? Definitely also thanks to strategic choice that EVA (Economic Value Added) analysis are performed for every strategically important decision being made.

Let’s look at the business of this multinational from another perspective. Sika Group is a collection of projects. Every project has its own returns and risks. Resources are limited, so decisions are rational. There is nothing wrong with the projects with relatively modest return, if very little is being risked. Also there is nothing wrong with high risks, if high returns are expected. To sum up, the company makes their decisions in line with the value generation and promotes those projects where most value is added with the underlying risks considered.

VBM decision-making in practice

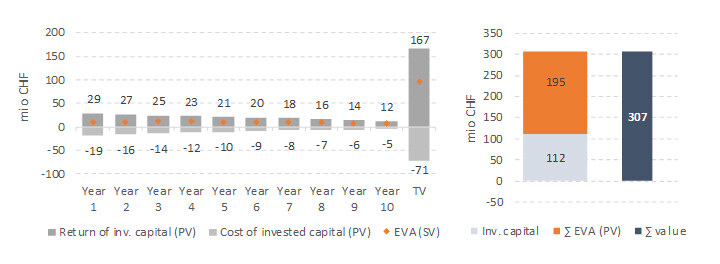

Demonstration of value-based management findings in case of Turkish company acquisition (graphic is symbolic; numbers are not actual):

Commentary of value-based management findings: Acquisition of Turkish company generates significant economic value added (chart: 195 mio CHF). Management proceeds with the execution of the acquisition, since ΣEVA (PV) is positive and in terms of relative project performance among the Tier I projects.

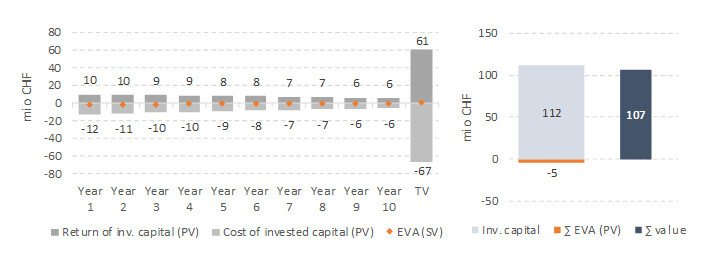

Demonstration of value-based management findings in case of new production line implementation (graphic is symbolic; numbers are not actual):

Commentary of value-based management findings: Purchase of production line for the penetration of selected developed markets with new products is not confirmed, since this decision, due to the relatively low profitability, destroys the value for shareholders (chart: -5 mio CHF). Management seeks alternative business opportunities.

As it can be seen from the two examples above, understanding of the economic value added is simple. This is making value-based management a desired approach for the decision-making. Furthermore, it is a uniformed system, that clearly prioritizes best projects and thus defines priorities of the company. The approach makes sure that the company does the right things first and only then the efficiency of making these right things is considered. In this way the comparison of short-term, mid-term and long-term choices is simplified; only top-notch investments are preferred; allocation of resources is improved; transparency of operations is better etc.

Value-based management is due to its advanced nature more and more often also referred to as smart management tool. It leverages all the knowledge of the capital markets in combination with advance analysis of operations, industry and market opportunities. It helps companies strengthen their relative power. In the long term, using value-based management means heading the optimal way forward, heading in the direction of success. The advantages of value-based management are well understood by the leading multinationals, this is way value-based decision-making is their preferred approach for quite some time already.